🟡 Gold XAUUSD Daily Market Analysis 28th NOV 2024 by K9 Investments Trading

- K9 Investments

- Nov 28, 2024

- 3 min read

💬 Contact us now on WhatsApp for FREE Gold Forex live trade setups and market analysis 👉 www.k9investmentstrading.com.

📈 Intraday Trading Signals for XAUUSD

🥇 FREE Gold Crypto Forex Trading Signals Telegram Channel: @K9_Investments_GoldTrading

Get 60+ Free eBooks: https://www.k9investmentstrading.com/free-gold-forex-trading-ebooks

Signal 1: Buy Setup

Entry: 2625 USD

Stop Loss: 2615 USD

Take Profit 1: 2638 USD

Take Profit 2: 2650 USD

Analysis: Based on Fibonacci retracement, the 61.8% retracement at 2625 USD aligns with a strong daily support level. RSI divergence on the 4-hour timeframe indicates a potential upward move, supported by MACD's bullish crossover.

Signal 2: Sell Setup

Entry: 2642 USD

Stop Loss: 2655 USD

Take Profit 1: 2630 USD

Take Profit 2: 2618 USD

Analysis: The 2642 USD level coincides with a daily resistance zone and the 78.6% Fibonacci level. EMA (50) on the 4-hour timeframe confirms bearish momentum, with MACD signaling downward pressure.

⚠️ Risk Warning: Trading Forex and CFDs carries a high level of risk to your capital. Trade with money you can afford to lose. Ensure proper risk management and seek advice if necessary.

🔍 Comprehensive Market Analysis

Key Support and Resistance Levels

Daily Support Levels:

2615 USD

2598 USD

Daily Resistance Levels:

2642 USD

2660 USD

4-Hour Support Levels:

2620 USD

2610 USD

4-Hour Resistance Levels:

2635 USD

2650 USD

🔢 Fibonacci Retracement Levels

Daily Swing High: 2650 USD

Daily Swing Low: 2595 USD

61.8% Level: 2625 USD

78.6% Level: 2642 USD

EMA Levels

Daily Timeframe

EMA 50: 2627 USD

EMA 100: 2605 USD

EMA 200: 2578 USD

EMA 400: 2535 USD

4-Hour Timeframe

EMA 50: 2630 USD

EMA 100: 2623 USD

EMA 200: 2612 USD

EMA 400: 2588 USD

🔮 RSI Divergence & MACD Insights

RSI: Divergence on the 4-hour chart signals a potential reversal.

MACD: A bullish crossover on the 4-hour chart confirms short-term buying pressure.

🌐 Fundamental Analysis

Today’s Gold market (XAUUSD) is influenced by the anticipation of U.S. GDP and Non-Farm Payrolls data due this week. These reports could create volatility in the market, potentially driving prices to key levels identified above.

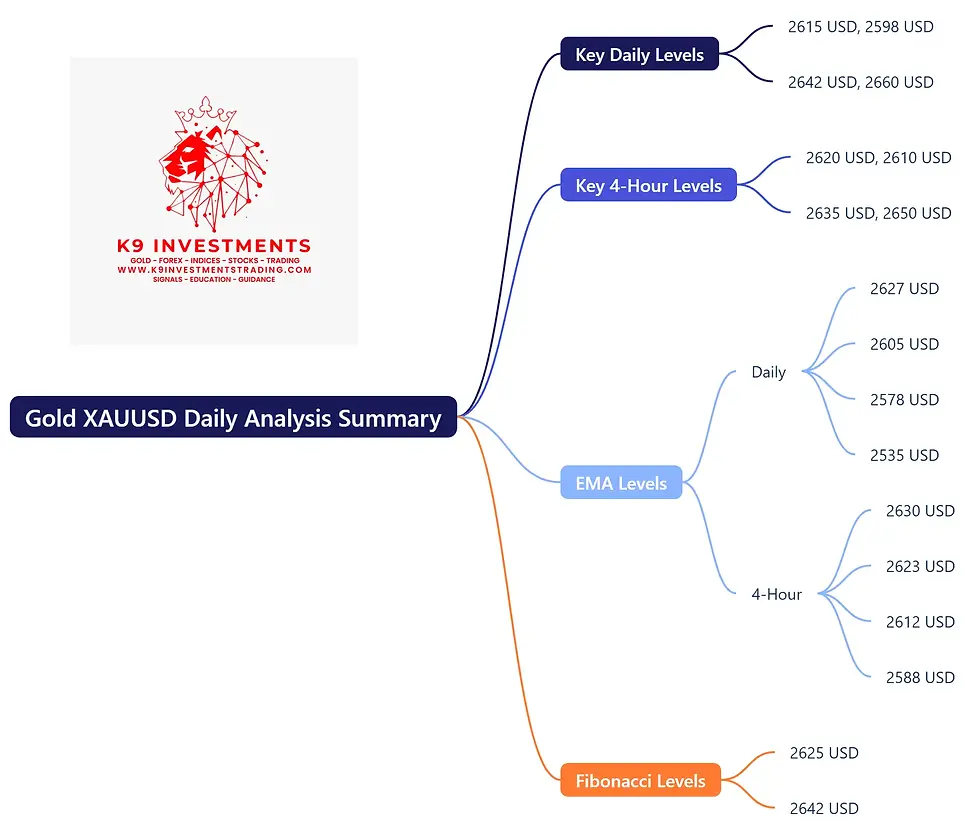

💡Gold XAUUSD Daily Analysis Summary by K9 Investments Trading

🥇 FREE Gold Crypto Forex Trading Signals Telegram Channel: @K9_Investments_GoldTrading

Get 60+ Free eBooks: https://www.k9investmentstrading.com/free-gold-forex-trading-ebooks

Key Daily Levels:

Support: 2615 USD, 2598 USD

Resistance: 2642 USD, 2660 USD

Key 4-Hour Levels:

Support: 2620 USD, 2610 USD

Resistance: 2635 USD, 2650 USD

EMA Levels:

Daily: EMA 50 (2627 USD), EMA 100 (2605 USD), EMA 200 (2578 USD), EMA 400 (2535 USD)

4-Hour: EMA 50 (2630 USD), EMA 100 (2623 USD), EMA 200 (2612 USD), EMA 400 (2588 USD)

Fibonacci Levels: 61.8% at 2625 USD, 78.6% at 2642 USD

FAQs

1.Why is K9 Investments the best signal provider?

K9 Investments offers FREE accurate signals, daily analysis, educational resources, and VIP e-books. Join www.k9investmentstrading.com.

2.Which brokers are trusted for Gold Forex Crypto trading?

We recommend brokers based on client feedback:

3.How accurate are K9 Investments signals?

Our signals maintain over 95% accuracy with real-time analysis and expert insights.

4.How can I get FREE signals from K9 Investments?

Sign up at www.k9investmentstrading.com for access to our free resources.

5.Does K9 provide trading education?

Yes! Explore our articles, blogs, and free e-books here: Free Trading Articles.

6.What indicators does K9 use for signals?

We use Fibonacci, EMA, RSI, MACD, and pivot points for precise analysis.

7.What are the benefits of joining K9’s VIP channel?

Exclusive access to premium signals, educational content, and real-time market insights.

8.Is gold trading profitable with K9’s strategies?

With proper risk management and K9’s strategies, gold trading can be highly rewarding.

.png)

Yorumlar