Gold XAUUSD Daily Market Analysis - March 5, 2025

- K9 Investments

- Mar 5

- 3 min read

💬 WhatsApp K9 Investments Trading here for FREE Gold Forex Live Trade Setups & Market Analysis.

Current Market Overview

As of today, the live market price of Gold (XAUUSD) stands at 2909 USD. In this analysis, we will delve into the daily and 4-hour time frames, utilizing various technical indicators to provide a comprehensive overview of the market.

Market Analysis

Support & Resistance Levels

Identifying support and resistance levels is crucial for effective trading. On the daily time frame, we observe the following levels:

Daily Support Levels:

Support 1: 2880 USD

Support 2: 2865 USD

Support 3: 2850 USD

Daily Resistance Levels:

Resistance 1: 2920 USD

Resistance 2: 2935 USD

Resistance 3: 2950 USD

On the 4-hour time frame, the support and resistance levels are slightly different, reflecting short-term fluctuations.

Fibonacci Retracement Levels

Utilizing Fibonacci Retracement Levels, we can identify potential reversal points. The daily swing levels for Fibonacci are:

Key Fibonacci Levels:

23.6%: 2910 USD

38.2%: 2895 USD

61.8%: 2870 USD

Exponential Moving Averages (EMA)

The Exponential Moving Averages (50/100/200/400) provide insights into the trend direction:

Daily EMA Levels:

EMA 50: 2895 USD

EMA 100: 2880 USD

EMA 200: 2870 USD

EMA 400: 2855 USD

4-Hour EMA Levels:

EMA 50: 2900 USD

EMA 100: 2890 USD

EMA 200: 2880 USD

EMA 400: 2865 USD

RSI Divergence

The Relative Strength Index (RSI) indicates potential overbought or oversold conditions. Currently, the RSI shows a divergence, suggesting a possible reversal in the near future.

Order Blocks

Identifying order blocks helps in understanding where significant buying or selling occurred. The most notable order block is around 2890 USD, which has previously acted as a strong support level.

MACD Analysis

The Moving Average Convergence Divergence (MACD) indicator is currently bullish, indicating that momentum may continue to favor buyers in the short term.

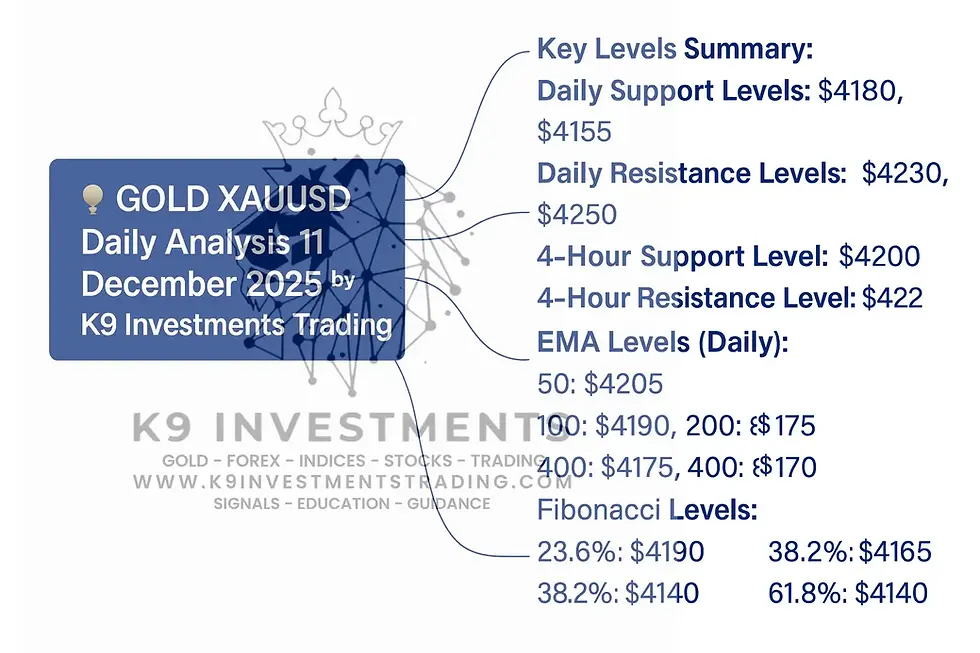

💡 Gold XAUUSD Daily Analysis Summary by K9 Investments Trading

For more insights, contact us on WhatsApp or join our FREE Telegram Channel: @K9_Investments_GoldTrading.

Key Levels Summary

Daily Support and Resistance:

Support: 2880 USD, 2865 USD, 2850 USD

Resistance: 2920 USD, 2935 USD, 2950 USD

Exponential Moving Average (EMA) Levels:

Daily: EMA 50 - 2895 USD, EMA 100 - 2880 USD, EMA 200 - 2870 USD, EMA 400 - 2855 USD

4-Hour: EMA 50 - 2900 USD, EMA 100 - 2890 USD, EMA 200 - 2880 USD, EMA 400 - 2865 USD

Weekly Pivots:

Pivot Point: 2900 USD

Resistance: 2925 USD, 2950 USD

Support: 2880 USD, 2855 USD

Daily Pivots:

Pivot Point: 2905 USD

Resistance: 2920 USD, 2935 USD

Support: 2890 USD, 2880 USD

Fibonacci Levels:

23.6%: 2910 USD

38.2%: 2895 USD

61.8%: 2870 USD

Upcoming USD News Impacting Gold

📈 Upcoming Important USD News:

Non-Farm Payrolls: Scheduled for March 10, 2025, which could lead to volatility in the Gold market.

CPI Data Release: Expected on March 15, 2025, may also influence Gold prices significantly.

Disclaimer

Risk Warning: Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary. Please read and ensure you fully understand our Risk Disclosure. Not Financial Advice. Trade at your own risk. Take Partial Profits, Use Strict Stop Loss and Proper Risk Management.

FAQs

Why is K9 Investments the best signal provider?

K9 Investments offers not only FREE signals but also educational resources, daily market analysis, and ebooks.

Which brokers are trusted for Gold Forex Crypto trading?

Based on client feedback, we recommend brokers like:

What educational resources does K9 Investments provide?

K9 Investments provides a range of educational resources, including:

How can I get free trading signals?

You can Get FREE Signals from K9 Investments Trading.

What is the importance of risk management in trading?

Effective risk management is crucial to protect your capital and ensure long-term success in trading.

How often should I analyze the market?

Regular market analysis is recommended, ideally daily or weekly, to stay updated with market trends.

What is the best strategy for Gold trading?

A combination of technical analysis, market news, and risk management strategies is often the best approach.

How can I join K9 Investments Trading community?

Join our community through our Telegram Channel for updates and insights.

.png)

Comments