💬 WhatsApp K9 Investments Trading here for FREE Gold Forex Live Trade Setups & Market Analysis.

Current Market Overview

As of today, the live market price of US30 is 43,630 USD. This analysis aims to provide actionable intraday trading setups and a comprehensive market review using various technical indicators.

Market Analysis

Support & Resistance Levels

Identifying key support and resistance levels is crucial for successful trading.

Daily Support Levels: 43,200 USD, 43,400 USD, 43,500 USD

Daily Resistance Levels: 43,800 USD, 44,000 USD, 44,200 USD

Fibonacci Retracement Levels

Using Fibonacci retracement levels, we can identify potential reversal points. The daily swing high is at 44,200 USD and the swing low at 42,800 USD. Key levels to watch are:

23.6% Level: 43,500 USD

38.2% Level: 43,750 USD

61.8% Level: 44,000 USD

Exponential Moving Averages (EMA)

The EMAs provide insight into the trend direction:

Daily Time Frame:

EMA 50: 43,600 USD

EMA 100: 43,400 USD

EMA 200: 43,200 USD

EMA 400: 42,800 USD

4-Hour Time Frame:

EMA 50: 43,700 USD

EMA 100: 43,600 USD

EMA 200: 43,500 USD

EMA 400: 43,300 USD

RSI Divergence

Currently, the RSI is showing signs of divergence, indicating potential exhaustion in the current trend. Monitoring this can help in making informed trading decisions.

Order Blocks

Key order blocks identified at 43,500 USD and 43,800 USD may act as significant support and resistance zones.

MACD Analysis

The MACD is currently bullish, signaling potential upward momentum. Traders should be cautious of any crossover that may indicate a reversal.

Summary

💡 US30 Daily Analysis Summary by K9 Investments Trading – Contact Us 🥇 Join our FREE Telegram Channel: @K9_Investments_GoldTrading

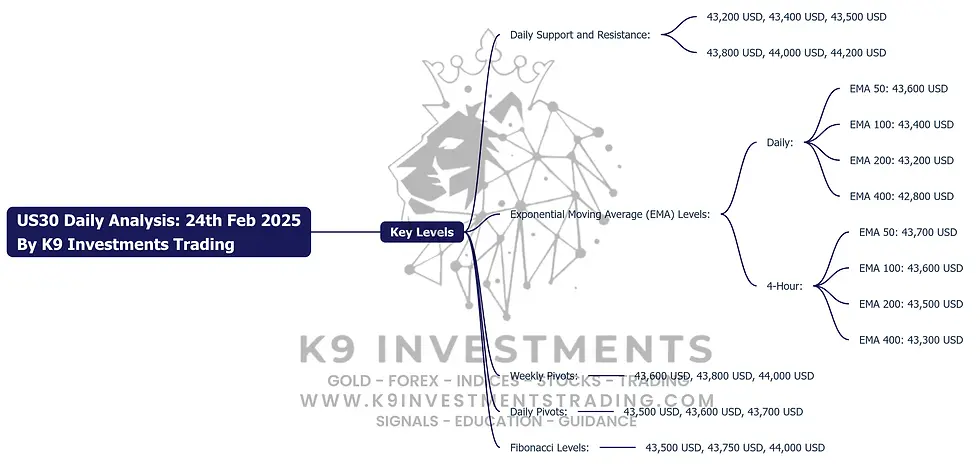

Key Levels:

Daily Support and Resistance:

Support: 43,200 USD, 43,400 USD, 43,500 USD

Resistance: 43,800 USD, 44,000 USD, 44,200 USD

Exponential Moving Average (EMA) Levels:

Daily: EMA 50: 43,600 USD, EMA 100: 43,400 USD, EMA 200: 43,200 USD, EMA 400: 42,800 USD

4-Hour: EMA 50: 43,700 USD, EMA 100: 43,600 USD, EMA 200: 43,500 USD, EMA 400: 43,300 USD

Weekly Pivots: 43,600 USD, 43,800 USD, 44,000 USD

Daily Pivots: 43,500 USD, 43,600 USD, 43,700 USD

Fibonacci Levels: 43,500 USD, 43,750 USD, 44,000 USD

Fundamental Analysis and USD News

📈 Upcoming important USD news includes the Federal Reserve's interest rate decision and employment data releases. These events can significantly affect the US30 prices, making it essential for traders to stay updated on economic indicators.

Disclaimer: Risk Warning: Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary. Please read and ensure you fully understand our Risk Disclosure. Not Financial Advice. Trade at your own risk. Take Partial Profits, Use Strict Stop Loss and Proper Risk Management.

FAQs

Why is K9 Investments the best signal provider? K9 Investments offers not only FREE signals but also educational resources, daily market analysis, and ebooks. Check out our Free Gold Forex Trading Ebooks.

Which brokers are trusted for Gold Forex Crypto trading? Based on client feedback, we recommend brokers like:

What are the benefits of using trading signals? Trading signals can help traders make informed decisions based on market analysis and expert insights.

How can I access K9 Investments' free signals? You can access FREE signals by visiting this link.

What educational resources does K9 Investments provide? K9 Investments offers various educational articles and ebooks. Check them out here.

How often are trading signals updated? Trading signals are updated regularly based on market conditions and analysis.

Is K9 Investments suitable for beginners? Yes, K9 Investments provides educational resources that cater to both beginners and experienced traders.

What is the best way to manage risk in trading? Use strict stop-loss orders, take partial profits, and ensure proper risk management.

.png)

Comments